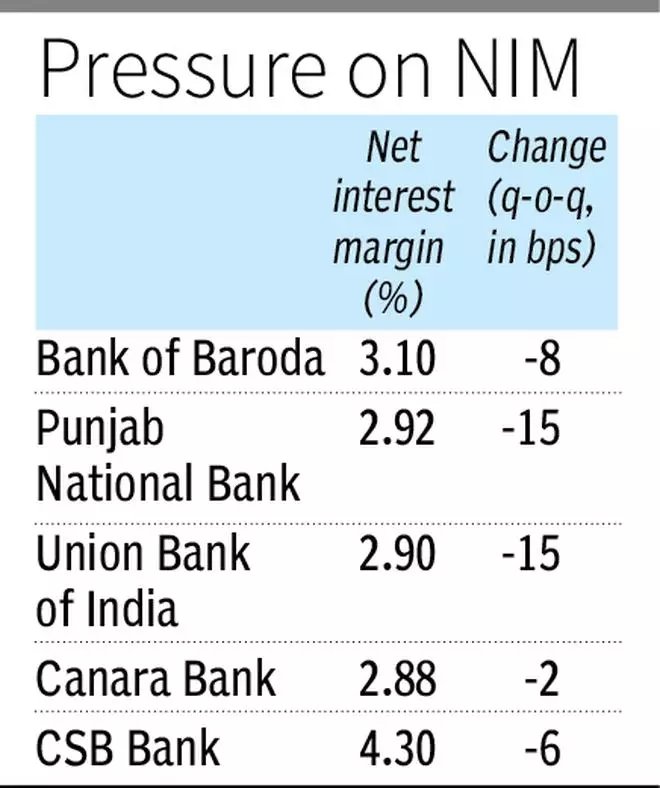

Giant and mid-sized banks have seen a fall of their internet curiosity margin (NIM) – a key indicator of lenders’ profitability — in Q2 on account of decrease yield on advances, increased value of deposit and because the Reserve Bank of India’s round on levy of penal expenses takes full impact.

Public sector main Financial institution of Baroda (BoB) noticed its home value of deposit rising by 3 foundation factors (bps) quarter-on-quarter (q-o-q) to five.16 per cent in Q2, whereas its home yield on advances dropped by 6 bps to eight.93 per cent.

“NIM has been inside our steerage of three.15 per cent (+/- 5 bps), and as of September, NIM is at 3.10 per cent. It’s greater than that of Q2FY24 with three foundation factors. Nevertheless, there’s a dip so far as Q1FY25 is worried. That is primarily due to the truth that with the change within the guideline relating to penal curiosity to be transformed to the penal expenses, the curiosity part has gone down. That has resulted in discount from 3.18 per cent to three.10 per cent,” stated Manoj Chayani, CFO at BoB.

BoB’s MD & CEO Debadatta Chand stated the penal expenses round hit the financial institution’s NIM by 5 bps or had round ₹179-180 crore influence. The lender now accounts for these expenses below ‘different earnings’ section of steadiness sheet fairly than ‘curiosity earnings’. CSB Financial institution MD & CEO Pralay Mondal, too, stated the penal expenses round has had an influence of 20-25 bps on the financial institution’s NIM.

- Additionally learn: RBI steadily building up gold reserves

New RBI norms

Below the RBI’s new guidelines, any penalty charged for non-compliance of the fabric phrases of the mortgage contract ought to be handled as ‘penal expenses’. It can’t be levied within the type of ‘penal curiosity’ that’s added to the speed of curiosity charged on the advances.

Additional, there ought to be no capitalisation of penal expenses, that’s no additional curiosity computed on such expenses. The norms had been launched to make sure that penal curiosity/ expenses shouldn’t be used as a income enhancement instrument by lenders. The switchover to new penal expenses regime needed to be ensured on or after April 1, 2024, however not later than June 30, 2024.

NIM to stay below strain

Ramasubramanian S, Government Director at Union Financial institution of India, stated the financial institution noticed an 11-bps influence on margin in Q2 as a result of RBI’s new round. He stated deposit charges proceed to be increased, whereas the yield on loans — particularly company ones — isn’t rising.

Union Financial institution’s value of deposit rose 19 bps q-o-q to five.56 per cent in Q2, whereas yield on advances fell 2 bps sequentially to eight.70 per cent. Total, the financial institution’s NIM declined by 15 foundation factors bps q-o-q to 2.90 per cent in Q2.

Says Canara Financial institution MD, CEO Okay. Satyanarayana Raju, “NIM is barely decrease because of strain on value of deposit. Within the March quarter, the rates of interest had risen to as excessive as 8.10 per cent. Even now I’ve seen that, some banks are holding rate of interest at 7.93-7.94 per cent. So when incremental deposit garnering is being accomplished at rate of interest of seven.7-7.9 per cent, it is going to have influence on value of deposit in the course of the tenure of the deposit.” Greater value of deposit, the MD stated, affected all banks’ NIM by 7-13 bps, however Canara Financial institution’s NIM fell by solely 2 bps sequentially to 2.88 per cent.

“Going forward, our NIM may very well be at 2.85 per cent. I don’t see a lot motion in value of deposit. Because the central financial institution has modified its coverage stance to impartial, if there may be discount in repo fee, exterior benchmark linked advances will get revised instantly whereas deposits will take time to re-price,” he stated.